As market indexes approach key psychological levels – 25,000 for the Dow, 9,000 for the Nasdaq, and 3,000 for the S&P 500 – some analysts, like those at IBD’s The Big Picture, warn of potential resistance ahead. Despite this, Capron remains optimistic about market resilience, citing the Federal Reserve’s economic stabilization efforts and China’s gradual reopening as positive factors for investors. He likens the current crisis to a natural catastrophe rather than a traditional recession, indicating that the market’s response reflects the temporary nature of this downturn.

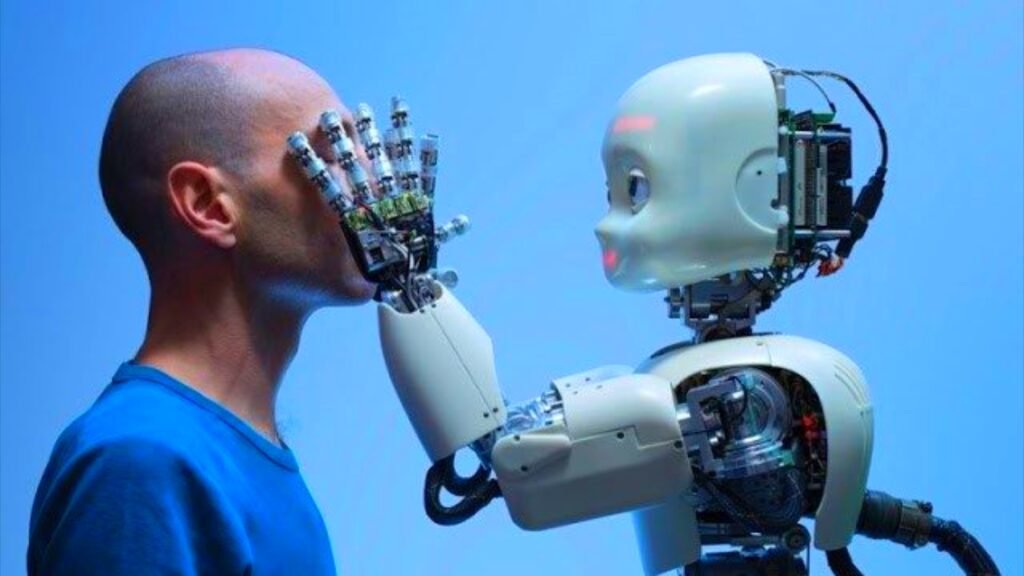

Capron, who leads research at ROBO Global, focuses on emerging trends in automation and robotics that are expected to fuel the next technological revolution. ROBO Global, the advisory and research firm behind the first-ever robotics and automation ETF, launched in 2013, offers investors a way to tap into the rapidly growing AI and robotics sectors. Capron predicts that these industries will mirror the tech boom of the past two decades, which saw internet companies rise from 0% to 10% of the S&P 500. He believes robotics and AI will play a similarly transformative role, not only in manufacturing but especially in healthcare, which he views as the next major sector poised for technological disruption.

The healthcare industry is already witnessing the convergence of AI and robotics, with these technologies creating significant opportunities for improving patient outcomes, physician capabilities, and healthcare operations. Capron highlights the potential for AI-driven robotics to revolutionize life sciences, from patient care to clinical operations. He emphasizes that this shift presents a unique growth opportunity for both investors and industry stakeholders as these innovations reshape healthcare.

For investors seeking exposure to this burgeoning market, Capron advises diversification through thematic funds like the ROBO ETF, which offers a broad portfolio of robotics and automation companies. Rather than betting on a few individual companies, Capron believes that a diversified basket of best-in-class stocks is the key to capturing the full potential of this technological wave. This approach is particularly important in a sector where market dynamics are constantly evolving and public markets provide ample opportunities for portfolio expansion.

Capron also discusses specific AI stocks with strong growth prospects, including Cognex and Brooks Automation. Cognex, a leader in computer vision systems for factory automation, recently saw its stock surge despite year-over-year declines, thanks to its promising role in the $10 billion computer vision market. Meanwhile, Brooks Automation, known for its expertise in semiconductor manufacturing, is expanding into biomedicine and genomics, leveraging its core technologies to build a robust bio-sample management business. Both companies illustrate how AI and robotics are opening up new avenues for investment across industries.