- What caused BlackBerry’s downfall?

- The untold story of the demise of a once-legendary company

- Is Apple the cause of BlackBerry’s downfall?

January 9th, 2007. In a San Francisco auditorium, Steve Jobs held a piece of polished glass and dared to call it the future. No keyboard. No stylus. Just… intuition.

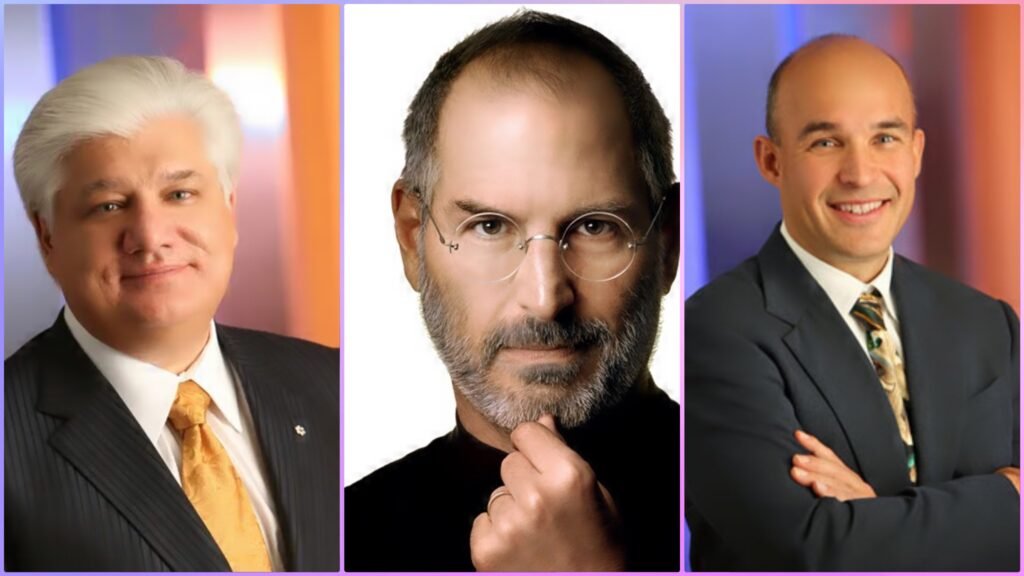

Meanwhile, A thousand miles north, in the snowy fortress of Waterloo, Ontario, BlackBerry’s titans watched the broadcast with icy detachment. Mike Lazaridis, the engineering genius who built an empire on physical keys and military encryption, dismissed it as a gimmick: ‘It’s an entertainment device,’ he declared. ‘Not for serious people.’ We’re a business tool. They don’t understand security.”

They commanded 43% of the smartphone market. Their devices sat in the palms of presidents, CEOs, and celebrities. Their stock soared past $80 billion.

Yet in that moment, as the crowd roared for Apple’s sleek slab, the foundation of BlackBerry’s kingdom began to silently fracture. This is not just a story of obsolescence. It’s a parable of hubris.

ASCENSION: THE UNDISPUTED KING OF CONNECTIVITY.

Before ‘smartphone’ entered the lexicon, BlackBerry was the silent revolution. Born in 1984 as Research In Motion (RIM), by two friends, Mike Lazaridis and Douglas Fregin, in Waterloo, Ontario, with a dream to redefine communication.

Starting with wireless modems and pagers, RIM hit a breakthrough in 1999 with the BlackBerry 850, a pager that could send and receive emails wirelessly—a game-changer in an era of clunky desktops. By 2002, the BlackBerry 5810 added phone and internet capabilities, storming the business world with its secure, always-on connectivity. BlackBerry became the go-to device for professionals, with its market share climbing to 43% in the U.S. by 2010. The 2006 launch of the BlackBerry Pearl, with its camera and consumer-friendly design, broadened its appeal, followed by the wildly popular Curve and Bold series. By 2012, BlackBerry had 80 million global users, and in 2008, its market cap hit approximately $83 billion, cementing its place as a tech titan.

THE UNBREAKABLE TRIAD: WHY THEY REIGNED SUPREME.

BlackBerry wasn’t just a phone; it was a productivity powerhouse. Three pillars held their empire unshakeable.

First: The Keyboard. Not just keys, but a masterpiece of engineered satisfaction. Each press was a gunshot of productivity, letting users fire off 100 words per minute with their thumbs. It was engineering as art – satisfying, efficient, irreplaceable.

Second: The Fortress. BlackBerry’s encryption wasn’t just secure; it was legendary. The NSA couldn’t crack it. Security was paramount—encrypted communications made BlackBerry the choice of the U.S. government and corporations worldwide, with even President Obama famously refusing to part with his.

Governments from NATO to the Pentagon certified it for Top Secret traffic. When terrorists attacked Mumbai in 2008, only BlackBerry Messenger (BBM) kept communication alive.

Third: The Endurance. While rivals gasped for battery life, BlackBerrys ran like diesel engines – 36 hours on a single charge. This was no toy. It was a titanium-clad workhorse for those who built nations and moved markets. Owning one wasn’t consumption; it was coronation.

THE BLIND SPOT: LAUGHING AT THE FUTURE.

The year 2007 marked a turning point. Apple unveiled the iPhone, a touchscreen marvel with a vibrant interface and a fledgling App Store. BlackBerry’s co-CEO, Jim Balsillie, reportedly scoffed, calling it an “entertainment device” unfit for serious business. Meanwhile, consumers marveled at the iPhone’s sleek design and multimedia capabilities, but BlackBerry clung to its keyboard-centric and business-focused strategy.

The tremors became earthquakes. Apple sold 1.4 million iPhones in 74 days. People didn’t just buy them; they worshipped them. Music! HD video! Maps that spoke! Apps that turned phones into lighters, slot machines, translators!

But Blackberry insisted that ‘They’ll come crawling back. ‘Glass screens are for teenagers. Real work needs real keys.’ They fatally misread desire. As time went by, Professionals didn’t want just email anymore; they craved an entire digital universe in their palms. The BlackBerry’s tiny, struggling browser – mockingly called the ‘Baby Internet’ by Steve Jobs – felt medieval next to Safari’s expansiveness. Developers fled to Apple’s App Store gold rush. BlackBerry’s response? A crippling refusal to believe the throne could crack. They were like Pharaoh commanding the tide.

In 2008, RIM rushed out the BlackBerry Storm, its first touchscreen phone, to compete. It was a disaster, plagued by sluggish performance and a clunky “clickable” screen, which drew scathing reviews despite initial sales. Meanwhile, BlackBerry’s app ecosystem lagged far behind Apple’s App Store and Google’s Play Store, which offered thousands of apps for everything from games to social media. By focusing solely on enterprise users and dismissing consumer trends, BlackBerry was losing its grip.

THE UNRAVELING: PANIC AND HALF-MEASURES.

The failure to adapt came at a steep price. BlackBerry’s U.S. market share plummeted from 43% in 2010 to 7.3% by November 2012, as Android and iOS surged to 53.7% and 35%, respectively. Financially, the company spiraled, posting a $518 million net loss in Q1 2013 and over $1 billion later that year. Layoffs hit hard—2,000 employees in 2011, followed by 5,000 more by 2013, slashing the workforce by nearly a third. The stock price, once $147 in 2008, crashed to single digits, wiping out billions in value. The BlackBerry 10 operating system, meant to be a savior, was delayed until 2013, and its launch, with devices like the Z10, failed to regain traction due to a sparse app store and outdated features. By 2016, with its market share at 0.9%, BlackBerry threw in the towel, announcing it would no longer make phones, pivoting to software and cybersecurity to survive.

THE USURPATION: HOW APPLE AND ANDROID DEVOURED THE KINGDOM.

Apple and Android didn’t compete; they consumed. Apple fused art with technology. The iPhone wasn’t a device; it was a lifestyle – a camera, a jukebox, a cinema, a portal. Android’s open floodgates let Samsung, HTC, and LG unleash a tsunami of affordable touchscreens with dazzling displays.

Both companies mastered marketing, turning their devices into cultural icons. By 2013, Android and iOS held over 90% of the U.S. market, capitalizing on consumer demands for multimedia, social media, and apps that BlackBerry had ignored, leaving it a relic of a bygone era.

ECHOES IN THE RUINS: LESSONS FOR THE NEXT WAVE.

BlackBerry’s downfall offers critical lessons for emerging phone companies.

- First, never underestimate competitors—Apple’s iPhone was dismissed, yet it reshaped the industry.

- Second, stay agile and responsive to market shifts; consumer preferences for touchscreens and apps caught BlackBerry off guard.

- Third, prioritize relentless innovation—invest in cutting-edge technology and robust app ecosystems.

- Fourth, execution matters; BlackBerry’s Storm and PlayBook tablets were poorly executed, eroding trust.

- Fifth, diversify your product line to appeal to both enterprise and consumer markets.

- Finally, financial discipline must be maintained to weather inevitable challenges. In a cutthroat industry, complacency is a death sentence—new manufacturers must innovate or risk obsolescence.

REQUIEM: THE GHOST IN THE MACHINE.

Today, BlackBerry survives as a specter – a cybersecurity whisper in the shadow of its former self. No empire is unbreakable. No customer is loyal. No innovation is permanent. The future belongs to the paranoid. To the restless. To those who understand that the only thing harder than reaching the summit… is knowing when to leap toward the next mountain. The keyboard’s click echoes only in memory now. A relic. A ghost. A king who forgot that in the kingdom of technology, revolution is the only constant.

THEY RULED THE WORLD.

THEY LAUGHED AT THE FUTURE.

THE FUTURE DID NOT FORGIVE.