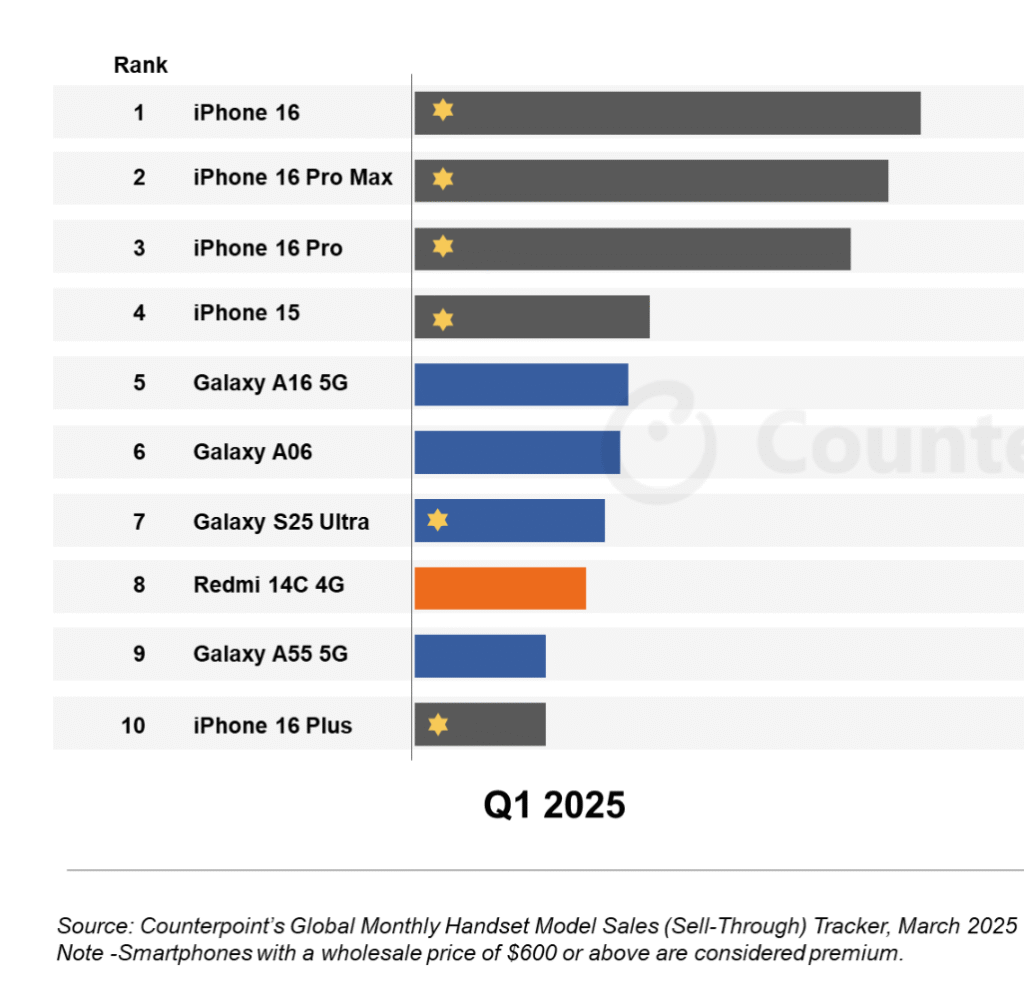

In the first quarter of 2025, Apple reclaimed its crown with iPhone 16 as the world’s best-selling smartphone, according to Counterpoint Research’s Global Handset Model Sales Tracker. This marks a notable comeback for the base iPhone model, which hadn’t topped the charts in the first quarter for the past two years. While it’s no surprise that Apple continues to dominate global smartphone sales, several key factors explain why the iPhone 16 outperformed the competition this time around, even against strong contenders like the Samsung Galaxy S25 Ultra.

Let’s break down the major reasons behind the iPhone 16’s stellar performance.

Positive Tech Reviews and Media Influence

From the moment the iPhone 16 series was unveiled in late 2024, tech reviewers across the globe showered it with praise. Reviewers emphasized its balanced performance, powerful A18 chip, enhanced camera system, and improved battery life—all packaged within a sleek, familiar design that many users love.

In contrast, competing flagship phones like Samsung’s Galaxy S25 Ultra received lukewarm or even critical reviews. Some leading tech personalities gave the S25 Ultra unflattering titles like “Bulky and Overengineered” or questioned its AI-first approach as premature. Even newer innovations such as the Galaxy S25 Edge, praised for its slim build, were often tagged with dismissive phrases like “Nobody Asked For This”, which could have contributed to reduced consumer interest.

This phenomenon highlights a subtle sociological impact—when top reviewers critique a product, it shapes public perception. Potential buyers often rely heavily on YouTube, blogs, and podcasts before making a purchase, and when the narrative skews negative, sales can suffer. On the flip side, the overwhelmingly positive reception of the iPhone 16 gave it a psychological advantage in the market.

The Power of Apple’s Ecosystem

Another strong reason for the iPhone 16’s success is Apple’s unique ecosystem. In a global smartphone landscape dominated by two major operating systems—iOS and Android—Apple stands out as the sole manufacturer in its ecosystem. That exclusivity fosters a tightly-knit user experience across devices like the iPad, MacBook, Apple Watch, and AirPods.

This seamless integration encourages user loyalty. If you own one Apple product, you’re likely to stick with the brand for others. Features like AirDrop, Universal Clipboard, iMessage, and Continuity Camera create a walled garden effect that many users find hard to leave.

On the Android side, brands like Samsung, Xiaomi, OnePlus, and Google share the same ecosystem, splitting the market and often lacking the tightly coupled user experience Apple offers. This divide allows Apple to dominate its segment unchallenged.

Prestige, Influence, and Brand Loyalty

Apple has spent over a decade cultivating a brand that exudes prestige, elegance, and innovation. The iPhone isn’t just a phone—it’s often seen as a status symbol. From Hollywood celebrities to global influencers, owning an iPhone is widely associated with affluence and influence.

According to industry insights, roughly 7 out of 10 celebrities and high-profile figures use iPhones, and that visibility translates into public desire. If your favorite actor or artist is using an iPhone, you’re more likely to want one too.

Additionally, Apple has built decades of trust by offering reliable security, user-friendly interfaces, and unmatched software support. It’s no surprise that the company enjoys one of the highest customer retention rates in tech. Even in tough economic times, loyal customers would rather buy a base model iPhone than switch brands.

Affordability in a Challenging Economy

In 2025, the global economy saw significant strain due to factors such as ongoing wars, shifting political powers, the U.S.-China import duty hikes, and the prolonged Russia-Ukraine conflict. These disruptions severely impacted the purchasing power of consumers worldwide.

While Apple’s Pro and Pro Max models continued to perform well, their sales saw a dip compared to previous years—especially in regions like China, where subsidies now favor more affordable options.

Here’s where the iPhone 16 base model became a strategic win. It provided most of the core features of the flagship line at a more accessible price point, making it the go-to choice for customers who wanted to remain in the Apple ecosystem without breaking the bank.

Japan and parts of the Middle East and Africa recorded the highest growth in base variant sales, thanks in part to subsidy adjustments and Apple’s refined pricing strategy in those regions.

Conclusion:

The iPhone 16’s Q1 2025 sales dominance wasn’t just due to brand loyalty or tech specs—it was the result of a multi-layered strategy combined with consumer psychology, global economics, and ecosystem strength. From glowing reviews and media buzz to a strong mid-range price point, Apple once again demonstrated its mastery of both technology and marketing.

While Samsung’s Galaxy S25 Ultra secured the seventh spot in Q1 2025, its shorter sales window (launched in February 2025) limited its impact compared to the iPhone 16, which had been available since September 2024.

In the end, the iPhone 16 didn’t just sell the most—it proved once again that a well-executed strategy can turn even a base model into a global superstar.