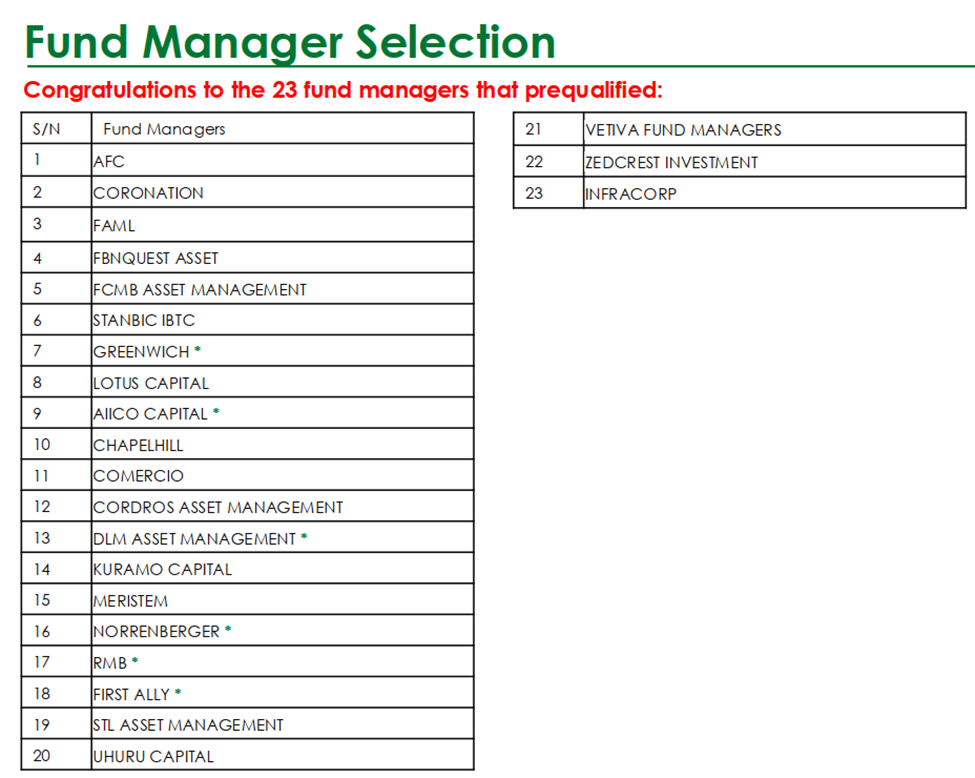

The Federal Government of Nigeria has appointed 23 fund managers to oversee the Nigeria Global Investment Fund (NGIF), a $10 billion initiative aimed at attracting both international and local capital into key sectors of the Nigerian economy. This fund is part of a broader strategy to reduce the country’s dependence on oil revenues by fostering growth in other vital areas such as agriculture, manufacturing, energy, infrastructure, and fintech.

Focus on Nigeria’s Industrial Revitalization Strategy

The NGIF, created by the Federal Ministry of Industry, Trade, and Investment, serves as a cornerstone of Nigeria’s industrial revitalization plan. The fund is designed to act as an umbrella organization, encompassing multiple sub-funds, each dedicated to specific sectors deemed critical for the nation’s development.

Rigorous Selection Process for Fund Managers

The Securities Exchange Commission (SEC) oversaw a stringent selection process for the fund managers, evaluating 55 applications before selecting 23 based on criteria such as expertise in public-sector partnerships, financial stability, and adherence to Environmental, Social, and Governance (ESG) principles. Notable fund managers include African Finance Corporation (AFC), Coronation Asset Management, Stanbic IBTC, AIICO Capital, and FBNQuest Asset Management.

Sector-Specific Sub-Funds to Drive Economic Growth

The NGIF is structured to include 14 sub-funds, each focused on a priority sector like automotive manufacturing, agriculture, pharmaceuticals, oil and gas, energy, fintech, and infrastructure. These sub-funds aim to raise an average of $500 million each, contributing to the NGIF’s goal of accumulating $10 billion in its first phase.

Strategic Allocation of Funds

Each selected fund manager is aligned with specific sectors based on their expertise. For example, Greenwich Asset Management, Coronation Asset Management, and Meristem Wealth Management will oversee real estate-focused sub-funds, while FBNQuest Asset Management and InfraCorp are tasked with infrastructure investments. These managers will not only raise capital but also ensure that investments are strategically directed to maximize impact across the targeted sectors.

Support from Development Finance Institutions

To bolster the NGIF, the government has secured significant backing from Development Finance Institutions (DFIs), including a $3 billion country risk guarantee from the African Export-Import Bank (Afreximbank). An additional $2 billion has been allocated for direct investments into crucial industries. These funds will be channeled into projects through various mechanisms such as project finance, equity investments, risk insurance, and advisory services.

Addressing Nigeria’s Infrastructure Deficit

The NGIF is set to play a pivotal role in addressing Nigeria’s infrastructure needs, which are estimated to require $14.2 billion in annual investment over the next decade. By mobilizing private capital, the fund aims to target sectors with the highest potential for economic transformation and job creation, contributing to the nation’s broader agenda of creating a $1 trillion economy within the next ten years as outlined in Nigeria’s Renewed Hope Agenda.

Background: The Road to Establishing the NGIF

Earlier in April 2024, the Federal Ministry of Industry, Trade, and Investment invited eligible firms to apply as Nigeria Diaspora Fund managers. This initiative was part of the groundwork for the $10 billion Nigeria Diaspora Fund, which is integral to the broader NGIF. Following the announcement by Minister Doris Nkiruka Uzoka-Anite, the application deadline was extended to May 13, 2024, allowing more companies to participate in this significant national investment project.